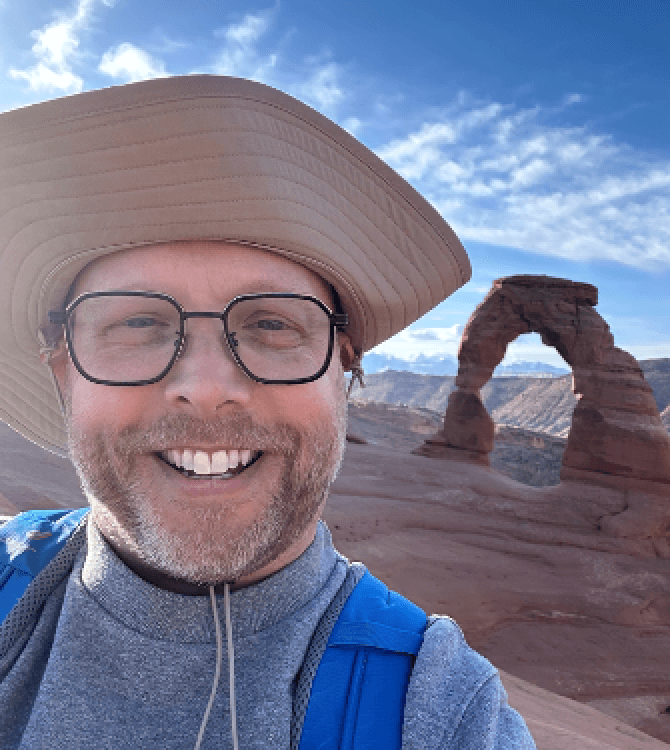

SAN FRANCISCO, CA – Feb. 17, 2025 – Cogenuity Partners (“Cogenuity”), a next-generation lower middle market private equity firm investing in critical businesses within the advanced industrial economy, today announced the appointment of Graham Banks as Director of Business Development. In this pivotal role, Banks will source new investment opportunities, cultivate key intermediary relationships, and lead banking partnerships to drive proprietary deal sourcing and growth across critical industry; empowering portfolio companies to achieve measurable, long-term advancements.

With years of experience in business development and investment sourcing at institutions including Silicon Valley Bank and Tide Rock, Banks brings deep sector expertise and a proven track record of driving growth and operational improvements. He holds a Bachelor of Science in Business Management from Westminster University and an MBA in Finance from the University of San Diego’s Knauss School of Business, positioning him to support Cogenuity’s mission of collaborating with management teams to responsibly build and scale industry-leading businesses.

“At Cogenuity, we invest in people and build genuine partnerships that deliver real results,” said Dan Delaney, Managing Partner & Founder of Cogenuity Partners. “Graham’s strategic mindset and extensive experience align perfectly with our approach of blending sector expertise with hands-on operational support. His leadership will enhance our ability to work closely with management teams and deliver forward-thinking solutions that drive measurable, long-term value.”

“I’m excited to join a firm that truly prioritizes authenticity, partnership, and sustainable growth,” said Banks. “I look forward to leveraging my experience to help our portfolio companies achieve operational excellence and lasting success.

Cogenuity Partners distinguishes itself by working closely with management teams from day one, using a customized, human-centric approach to accelerate growth and secure sustainable value. Since closing its debut $425 million fund in January 2025, Cogenuity has rapidly expanded its team, attracting top talent with deep expertise in investing, operations, and the industrial sectors. Central to its strategy is the Collaborative Operations (CoOp) Program, which seamlessly integrates hands-on operational support with strategic capital to empower businesses like portfolio company United Safety & Survivability Corporation (USSC) to thrive in competitive markets.

For more information about Cogenuity and its innovative approach to private equity, visit http://www.cogenuity.com/

ABOUT COGENUITY

Cogenuity Partners is a lower middle market private equity firm investing in essential businesses within the advanced industrial economy. We combine deep industry expertise with hands-on operational support to build long-term value and drive sustainable growth. For more information, visit www.cogenuity.com.