Collaboration Ingenuity.

We Keep the World Moving.

We collaborate with our portfolio companies in an effort to responsibly build and scale industry-leading businesses. We invest in organizations that we believe are essential to building a future we can all look forward to while creating wealth and advancement opportunities for the employees.

Next Generation Private Equity

- Advanced Materials

- Aerospace & Defense Components & Materials

- Analytical Instrumentation

- Coatings, Adhesives, Sealants, and Elastomers (CASE)

- Engineered Components and Systems

- Filtration

- Fire & Life Safety

- Flow & Process Control

- Interconnect Solutions

- Medical Devices & Components

- Seals & Gaskets

- Specialty Pumps & Valves

- Data Center Products & Services

- Energy, Power, and Utility Products & Services

- Infrastructure Maintenance Solutions

- Transportation Products & Services

- Water & Wastewater Products & Services

Technology

- Automation, Conveyance, and Robotics

- Process Control Solutions

- Remote Monitoring Solutions

- Sensors, Detectors, and Probes

- Software-Enabled Critical Products & Services

- Air Quality Testing & Permitting

- Electrical & Mechanical

- Environmental & Waste

- Facility Services

- Field Services

- Infrastructure Rehabilitation & Life Extension Services

- MRO Services

- Quality Assurance & Control Services

- Testing, Inspection, Certification & Compliance Services

- Utility Services

Up to

We're not generalists; we are specialists in the industrial sector, with decades of experience focused on businesses that provide essential products and services to diverse end markets. We leverage our deep knowledge and experience in an effort to amplify your unique strengths and accelerate your trajectory.

Partnership. Performance. Progress.

We strive not to operate like a traditional private equity firm. We hold ourselves accountable to be radically responsive, to bring ingenuity, and to collaborate closely with management teams from day one. While other firms may dictate actions, we focus on partnering with you to bring your strategies to life and help you “connect the dots” more quickly.

Certain statements about Cogenuity made by portfolio company executives herein are intended to illustrate Cogenuity’s business relationship with such persons, including with respect to Cogenuity’s facilities as a business partner, rather than Cogenuity’s capabilities or expertise with respect to investment advisory services. Portfolio company executives were not compensated in connection with their participation, although they generally receive compensation and investment opportunities in connection with their portfolio company roles, and in certain cases are also owners of portfolio company securities and/or investors in Cogenuity-sponsored vehicles, including on a discounted basis. Such compensation and investments subject participants to potential conflicts of interest in making the statements herein.

Value Added Partners With You.

Our Collaborative Operations (CoOp) team works with management to execute growth strategies from the first day we begin working together.

Traditional

- Mandate Makers

- Generalists

- Model Junkies and Buy Cheap Mentality

- Driven by Short-Term Profits

- Distant & Demanding

Cogenuity

- Collaborators Bringing Support

- Specialists

- Investment, Operations, & Functional Business Experience

- Driven by People & Performance

- Authentic & Human

We believe social and environmental responsibility isn’t just good ethics – it’s good business. We integrate ESG principles into every aspect of our operations and investments, in an effort to drive value for our companies, employees, and the communities we serve. Our approach is clear and practical: track, report, and improve.

Social and environmental responsibility isn’t just good ethics – it’s good business.

Our individual experiences create differentiated perspectives. We believe that successful organizations create performance-based cultures where employee diversity is embraced and celebrated.

Building value means that everyone – from machinists and engineers to CEOs and our Cogenuity team – contributes as their true, authentic selves each day. By embracing this approach, we create a culture of trust, collaboration, and innovation that drives success at every level.

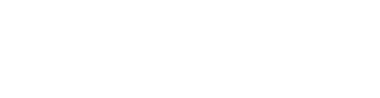

The Team Behind the Collaboration

Operating Partner

News and Updates

Cogenuity Welcomes Michael Ouyang as Managing Director

FOR IMMEDIATE RELEASE SAN FRANCISCO, CA – 10/9/2025 – Cogenuity Partners (“Cogenuity”), a next-generation lower middle market private equity firm investing in critical businesses within the advanced industrial economy, today announced the addition of Michael Ouyang as Managing Director. In

Featured Insights and Perspectives from Cogenuity

At Cogenuity we have deep experience investing in and operating critical products and services businesses in the advanced industrial economy. We know these markets and we know how to build and scale great industrial businesses. Collaborative Insights shares our views on a selection of latest insights, ideas, and trends.

Perspectives on the Transforming Landscape of U.S. Power & Electricity

At Cogenuity Partners, we have decades of experience as operators and investors across the power and infrastructure industry. The U.S. power sector is going through a once-in-a-generation transformation driven by dynamic load growth

Driving Growth Through Operational Excellence in Fire Protection

At Cogenuity Partners, we have deep experience as investors and operators in in the advanced industrial economy. We live by our principles of Collaboration and Ingenuity to partner with our portfolio companies in

We’re real people, committed to partnering with businesses in a way that’s as honest as it is effective. We invest in our people, our vision is long-term, and we love what we do.

Collectively, we decided to approach business differently after being a part of the traditional PE experience for a combined 70+ years. We vowed to inject hard-won insights of challenges, opportunities, and experience in an unconventional way – driving lasting impact that goes beyond just the bottom line.